On Paper We Do Have Enough – Part 4

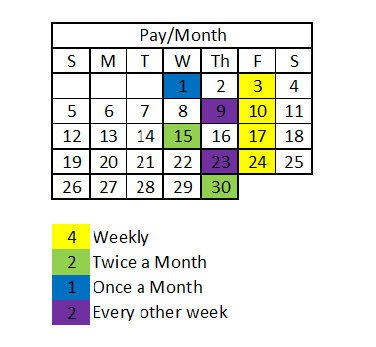

Let’s take a closer look at the “Pay/Month” calendar from my last post, The One Big Problem All Bill Payers Face. We need to figure out or simply state which of the four pay categories you fit into.

The Four Pay Categories:

- Weekly – You fit into the weekly pay category if you get paid every week or once each week. This is one of the rare pay categories. There aren’t many people who fall into this category of getting paid every week. I would love that, but it’s not for everyone.

- Every other week – To fit into this category, your payday comes every other week. For example, you get paid every other Friday. You receive a check one Friday, skip a Friday, then when next Friday rolls around you’re paid again.

- Twice a month – “Twice-ta-month”, this is how old people say this one. It just means, you receive just 2 paychecks in any given month. This category’s pay goes a little like this. You receive pay on the 15th and the last day of the month (or the 1st day of the month).

- Once a month – Probably the hardest pay category to budget, this fourth one is the get paid “once a month” one. Just as it says, you get one paycheck in a given month. You have to wait a whole month before another rolls through.

Money in Hand

Now that you know what category you fall, it’s time to understand how much money you really have. Before you write down how much money you get per payday, let me say this. We don’t care about how much is on paper. We don’t care how much they say we make. We will only count the money we get in hand. That’s how much money you really make. So if you get paid “twice-ta-month”, your money in hand may look like this.

- Payday 1 (15th) – $700

- Payday 2 (30th) – $700

This is very important to know and come to grips with. Understand that the amount isn’t as important as knowing what you truly have available.

Take this moment and jot down how much you have in hand for each one of your paydays. This exercise is the easy part. As I’ve stated before, you have at max four line items to write down.

is available now!

Our team has worked very hard putting it together. We designed it to help you and your family move the needle forward in making your life your business.

Find out more about the Family plan here.

is available now!

Our team has worked very hard putting it together. We designed it to help you and your family move the needle forward in making your life your business.

Find out more about the Family plan here.Today is Friday!

Your money is just that your money, just like your life is your business. You get to use it however you choose and just like everyone else, 100% of your money is your money. Let’s learn together how to use it better. Next week, we will perform the match between your listed paydays and the bills you have. Then the magic will begin.

[…] Let’s get started. The goal today is to take your bills and spread them across your set paydays. Just like you have a todo list in your office or on your bedroom dresser for the things you need […]